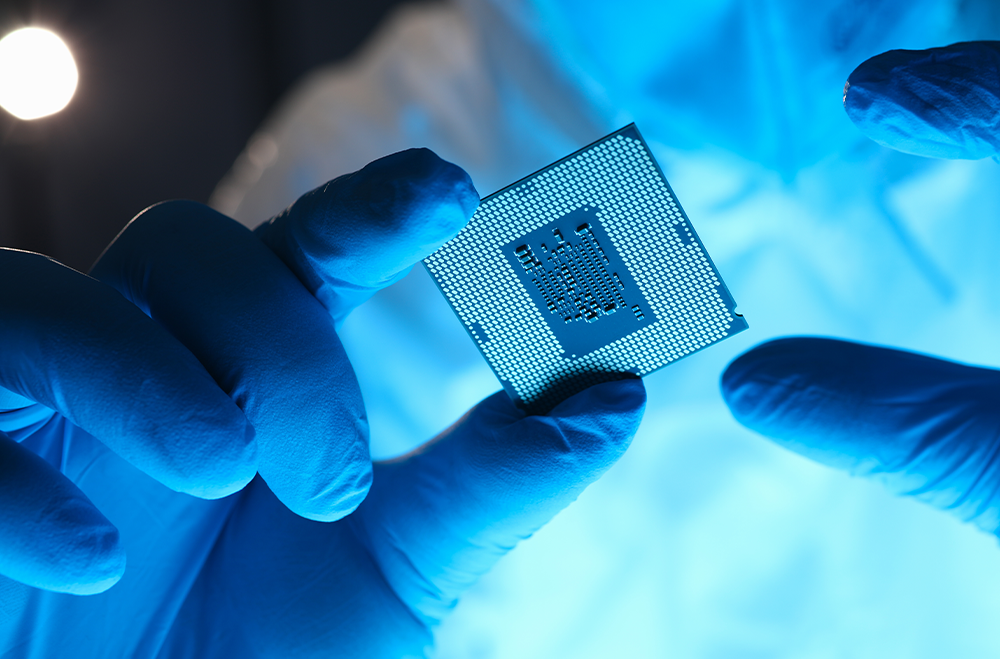

This exciting transaction will combine both companies’ individual strengths in the high-end semiconductor market and follows the strategy to further diversify the wet-chemical surface treatment manufacturer’s product and service portfolio and approach to the US semiconductor market. With outstanding machine and process solutions for wet-chemical processing both RENA and MEI have complementary product portfolios and regional strengths to form a global player in the international semiconductor market.

This exciting transaction will combine both companies’ individual strengths in the high-end semiconductor market and follows the strategy to further diversify the wet-chemical surface treatment manufacturer’s product and service portfolio and approach to the US semiconductor market. With outstanding machine and process solutions for wet-chemical processing both RENA and MEI have complementary product portfolios and regional strengths to form a global player in the international semiconductor market.

RENA’s main markets are Europe and Asia while MEI has an established track record within the US high-tech semiconductor sector. Synergies can be found in the regional distribution of both companies’ customer base as well as their local service organisations, which allows them to offer a complete service portfolio. Together, the companies can cover all wet-chemical process steps of semiconductor processing, from best-in-class prime wafer processing to state-of-the-art MEMS, SiC and semiconductor processing including Batch Immersion, Batch Spray, and Single-wafer applications.

“MEI’s and RENA’s product portfolios complement each other extremely well” said Peter Schneidewind, CEO of RENA, “We strongly value the expertise of our new colleagues from MEI and are delighted to be able to offer our customers comprehensive solutions for semiconductor wet-processing equipment on a worldwide scale.”

“With a large number of orders in our backlog, we’re happy to join RENA Group, which provides us with a range of opportunities in regard to global market access and synergies in services, R&D, and production. This gives MEI the chance to advance to the next level globally,” added Ed Jean, CEO of MEI.

“We are absolutely convinced, that this combination brings superior value for our customers through an extended product portfolio and our joint global service team,” both CEOs summarised.

About MEI Wet Processing Systems and Services LLC

MEI LLC of Albany, Oregon, is a wet-processing equipment and services company serving the semiconductor, MEMs, solar, and high-technology industries. MEI’s specialities include patented solutions for wet-processing applications, including metal lift-off, advanced wafer etching, wafer stripping, and wafer cleaning solutions. Exceptional process control is provided through MEI’s proprietary IDX Flexware process control software.

About RENA Technologies GmbH

“THE WET-PROCESSING COMPANY”

RENA Technologies is a global leader in manufacturing production machinery for wet-chemical surface treatment. RENA products are used in groundbreaking areas of application such as semiconductors, med-tech, renewable energies and the glass industry. With RENA systems, surfaces such as semiconductor wafers, solar cells, optical substrates, dental implants and other high-tech products are treated or modified using wet-chemical processes. RENA offers tried-and-tested standard machines as well as customised solutions, process support, and chemical performance additives.

Dan Cappello, Chairman at MEI said:

“In Acuity Advisors and their lead partner on our deal, Marcus Allchurch, MEI Wet Processing Systems and Services, LLC found the ideal representative in the sale of our business to Rena GmbH. From start to finish, Acuity was able to quickly understand the technical nature of our business, articulate the value proposition, and canvas our industry globally to find the perfect long term strategic and cultural fit for our business.

Additionally, not only is everyone at Acuity enjoyable to work with, they were also tireless in their efforts on our behalf and exhibited a commitment to meeting MEI’s high standards and expectations that never waned. We couldn’t be more pleased with Acuity and the ultimate result they achieved for our employees, customers and ownership. Thank you to Marcus, Brian, Matthew and the entire Acuity team!”

Marcus Allchurch, Partner at Acuity said:

“It is a pleasure to have delivered this exciting transaction, bringing together two excellent companies to create a leading international platform. The sale of MEI to RENA once again demonstrates Acuity’s outstanding track-record in delivering cross-border transactions, and our expertise in working with private equity. I wish the sellers and all the team at RENA and MEI every success for the future.”

Matthew Byatt, Managing Partner at Acuity said:

“An excellent result for both MEI and RENA – a transaction where Acuity played an instrumental role. This transaction highlights once again our commanding position in the semiconductor sector as we continue to provide the industry with world class cross-border M&A advisory services.”

“In Acuity Advisors and their lead partner on our deal, Marcus Allchurch, MEI Wet Processing Systems and Services, LLC found the ideal representative in the sale of our business to Rena GmbH. From start to finish, Acuity was able to quickly understand the technical nature of our business, articulate the value proposition, and canvas our industry globally to find the perfect long term strategic and cultural fit for our business.

Additionally, not only is everyone at Acuity enjoyable to work with, they were also tireless in their efforts on our behalf and exhibited a commitment to meeting MEI’s high standards and expectations that never waned. We couldn’t be more pleased with Acuity and the ultimate result they achieved for our employees, customers and ownership. Thank you to Marcus, Brian, Matthew and the entire Acuity team!”

DAN CAPPELLO | Chairman

MEI Wet Processing Systems & Services LLC

Marcus joined Acuity in 2014, before which he held senior leadership and corporate finance positions with some of the UK’s most successful advisory and telecoms businesses. Roles with EE, KPMG Corporate Finance and BDO Corporate Finance have seen Marcus work in the UK and across the globe with successful entrepreneurs seeking exit, and at board level with multi-national corporates looking for growth through organic and inorganic investment.