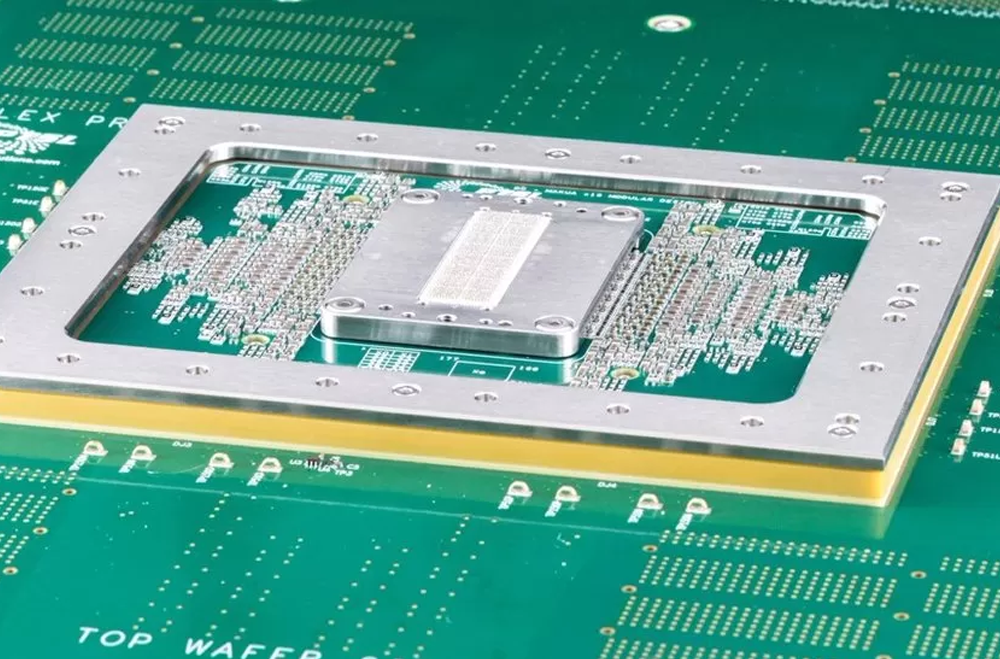

PTSL designs and manufactures probe cards. Founded in 2009 and headquartered in Glasgow, Scotland, it has a presence in Europe, the US and Asia. With a compound annual revenue growth rate of over 30% for the last 10 years, PTSL is one of the fastest growing Automated Test Equipment (ATE) suppliers in the semiconductor industry with an innovative product offering, an experienced technical team, and a diverse customer base across the globe.

Tikehau Capital’s investment is made via its pan-European growth impact private equity strategy. The strategy’s investment philosophy is focused on providing partnership capital to high growth, purpose-led companies that are critical to the resilience of the European economy.

Through this partnership, Tikehau Capital will provide PTSL with the operational and strategic support needed to accelerate further international expansion, and to consolidate its market-leading position.

Acuity served as exclusive financial advisor to PTSL.

Jordan Mackellar, CEO and Co-Founder, PTSL says:

“We are extremely excited with the investment from Tikehau Capital, a strong endorsement of the PTSL team’s exceptional performance in recent years and in our future growth strategy. This is the first investment in PTSL since inception and allows us to accelerate our technology innovation and help continue scaling up while also considering accretive acquisitions.

Acuity helped us complete this transaction in record time. Their strong and cohesive team forged excellent links with the PTSL team, providing value, support, and drive throughout the process. Huge thanks to Matthew, James, Naomi and the team for their hard work in making the process seamless for all.”

Matthew Byatt, Managing Partner, Acuity Advisors said:

“We are delighted to have assisted Jordan and the PTSL team on this exciting milestone. The future is very bright for PTSL, and we are looking forward to watching the team and company grow. This is another example of Acuity’s ability to leverage its deep semiconductor industry know-how to provide great transaction execution throughout the industry’s mid-market eco-system.”

James Smith, Vice President, Acuity Advisors said:

“It has been a pleasure working with Jordan and the exceptional PTSL team to secure this fantastic growth investment. With Jordan’s leadership and the high-quality team behind him, we are very much looking forward to watching the business’ future success.”

“Acuity helped us complete this transaction in record time. Their strong and cohesive team forged excellent links with the PTSL team, providing value, support, and drive throughout the process. Huge thanks to Matthew, James, Naomi and the team for their hard work in making the process seamless for all.”

JORDAN MACKELLAR | CEO & Co-Founder

PTSL