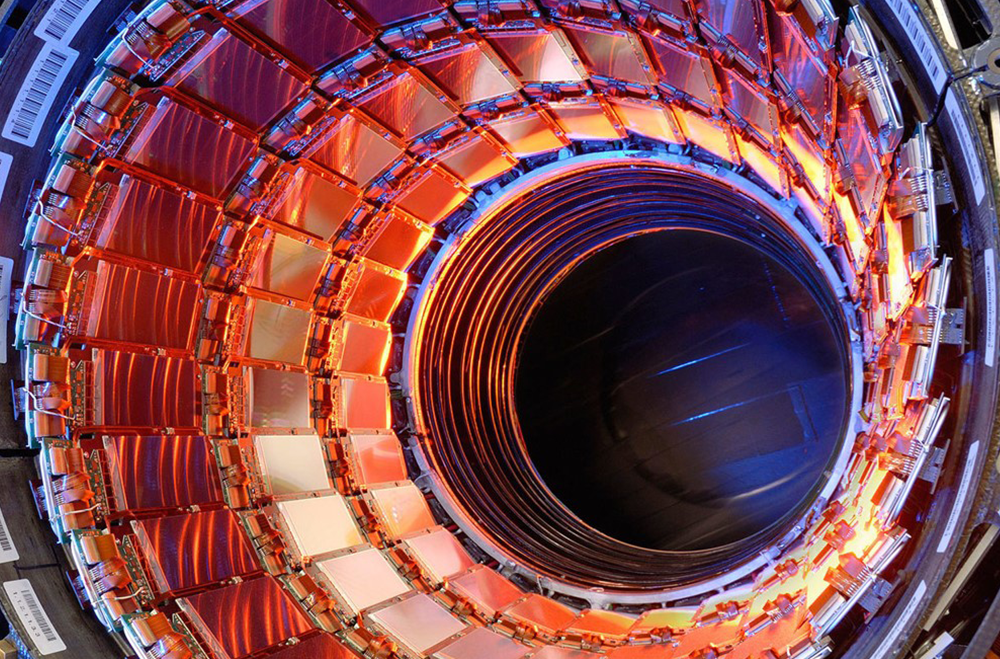

Founded in 1998 and headquartered in Solkan, Slovenia, I-Tech is the global market leader in the development and assembly of high-specification instrumentation for data acquisition and signal processing used in scientific particle accelerators. Also core to the I-Tech strategy is utilising the company’s know-how and R&D capabilities to develop instrumentation for medical proton therapy applications as well as broader industrial markets.

Founded in 1998 and headquartered in Solkan, Slovenia, I-Tech is the global market leader in the development and assembly of high-specification instrumentation for data acquisition and signal processing used in scientific particle accelerators. Also core to the I-Tech strategy is utilising the company’s know-how and R&D capabilities to develop instrumentation for medical proton therapy applications as well as broader industrial markets.

The transaction also includes Red Pitaya (www.redpitaya.com), a handheld electronics lab incorporating instruments such as oscilloscopes and signal generators, which is seeing widespread adoption among signal processing engineers, hobbyists and students.

ARX acquired the company from its founders, who were advised in the transaction by Acuity Advisors. Financial details of the transaction were not disclosed. Completion of the transaction is subject to customary closing conditions. As part of the transaction, ARX agreed to partner with the company’s existing management team who will lead the future growth and development of the Company.

Rok Ursic, Founder of Instrumentation Technologies, commented: “When I founded I-Tech in 1998 my mantra was “reach high” and this spirit permeated the company from its inception. It allowed us to attract the best tech talent in the region and grow and develop I-Tech to where it is today from scratch. Together we built a world class organisation and I would like to thank all the people that stood by my side. I-Tech is in excellent condition, the best in the history of the company, and I would like to thank ARX for recognising its potential. I am confident that together with the I-Tech team they will write an even more successful story. And I am totally dedicated to my new startup now.”

Brian Wardrop, Managing Partner at ARX Equity Partners, commented: “ARX is delighted to partner with I-Tech, which as an outstanding example of a highly successful Slovenian entrepreneurial success story. Our primary aim will be to support the I-Tech team in order to grow and develop the company organically. The ARX track record contains several successful Slovenian investments – and we are excited to make another investment in the country and to embark on this growth and development journey with I-Tech.”

Elvis Janezic, CEO at Instrumentation Technologies, commented: “Together with our new partner we look forward to continuing and accelerating our innovation-driven strategy, while serving our customers with the highest performance instruments for particle accelerators. We will also focus on expansion opportunities in adjacent industries where we are uniquely positioned to deliver solutions developed by I-Tech’s world-class technical team.”

Rok Ursic, Founder of Instrumentation technologies, commented:

“It was a humbling experience to learn that selling a company requires a very different skill and mind-set than founding and growing it. We were lucky to have Matthew Byatt from Acuity lead the team, helping us navigate this process that resulted in a successful outcome. They grasped Instrumentation Technologies’ technological edge and team strength in a surprisingly short time, helped us articulate that concisely and supported us throughout the negotiation process with diligence and situational sensitivity. We are extremely pleased to have selected Acuity Advisors – we honestly think we couldn’t partner with a better adviser – and we thank them for their great support.”

Matthew Byatt, Managing Partner at Acuity Advisors, commented:

“I-Tech is a European entrepreneurial success story in the advanced industrial technology sector. Building on top of a dominant position in particle accelerators, the company has great opportunities for growth in the proton therapy and broader industrial data capture market. With ARX as new shareholder, I-Tech is very well positioned to capture this potential. We were delighted to assist shareholders in this process and wish I-Tech a great future.”

“It was a humbling experience to learn that selling a company requires a very different skill and mind-set than founding and growing it. We were lucky to have Matthew Byatt from Acuity lead the team helping us navigate this process that resulted in a successful outcome. They grasped Instrumentation Technologies technological edge and team strength in a surprisingly short time, helped us articulate that concisely and supported us throughout the negotiation process with diligence and situational sensitivity. We are extremely pleased to have selected Acuity Advisors – we honestly think we couldn’t partner with a better adviser – and we thank them for their great support.”

ROK URSIC | Founder

Instrumentation Technologies

Matthew is a Co-Founder and Managing Partner at Acuity and leads the Acuity Advisors’ Deeptech practice.

Matthew has held senior leadership and corporate finance positions with some of the UK’s most successful and influential technology and consultancy companies. Roles with ARM, McKinsey and Cadence have given Matthew an exceptional insight into the world’s most successful businesses and a number of the UK’s eminent start-ups, underpinning his success at Acuity.

Matthew has considerable experience across a broad range of technology sectors throughout the UK, US and Asia, ranging from nanotechnology, semiconductor and cleantech to digital media and internet businesses. It’s experience that has given him a robust, well-developed and international network. Having also run and successfully exited his own business, Matthew has a deep understanding of the financial and emotional aspects of this demanding process, bringing a unique and authoritative perspective to each business sale.

One of Matthew’s strengths is understanding complex technical value propositions, one of the benefits of training as an electronic engineer. He gets to the heart of what drives a company’s value and communicates this persuasively to potential buyers and investors. Matthew understands a buyer’s motivation intuitively and delivers a compelling rationale for why a business sale should be of strategic interest. His insight consistently yields higher deal values and results in great successes for his clients.